An Unveiling of Alleged Corporate Misconduct

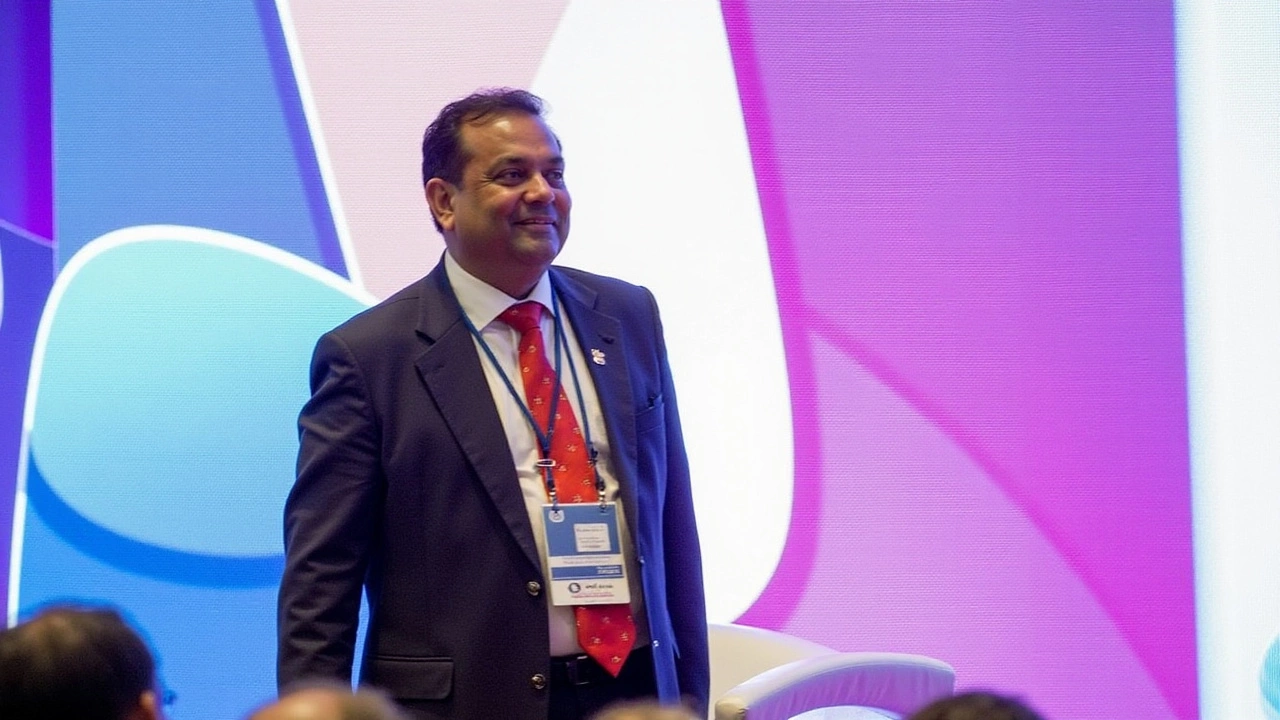

The world of international business has been shaken by a monumental revelation involving Gautam Adani, a renowned figure in India's corporate landscape. The U.S. federal court in Brooklyn recently unsealed an indictment that has sent ripples through global markets. At the heart of this legal storm is Gautam Adani, aged 62, the influential chairman of the Adani Group, a conglomerate with diverse business interests. The charges unveiled are significant, accusing Adani, along with seven other senior executives, of orchestrating a complex bribery scheme designed to sway Indian government officials in favor of Adani Green Energy's aspirations.

The indictment suggests that the alleged bribes were not modest in scale but spanned a staggering $265 million. These bribes were purportedly deployed strategically to secure solar energy contracts, a sector where Adani Green Energy holds an impactful presence. The scope of the accusations does not end with bribery alone. The charges also encompass securities and wire fraud, violations of the Foreign Corrupt Practices Act, and obstruction of justice. These are severe allegations that paint a concerning picture of malfeasance within the upper echelons of the Adani Group.

The Implications for U.S. Investors

The ramifications of these charges extend beyond the sphere of Indian business, striking at the heart of U.S. financial markets and investor interests. The indictment accuses the defendants of misleading U.S. investors and global financial institutions by concealing the true nature of their financial dealings. These misleading disclosures reportedly facilitated the raising of a colossal $3 billion through loans and bond offerings. The funds were ostensibly raised to finance what has now been alleged as a corrupt and fraudulent scheme, impacting a vast network of international financial exchanges.

Parallel to these criminal charges, the U.S. Securities and Exchange Commission (SEC) has stepped in with a civil lawsuit against Gautam Adani and two other co-defendants. The SEC alleges violations of antifraud provisions within U.S. securities laws, amplifying the consequences Adani faces in this multifaceted legal ordeal. These civil suits are indicative of U.S. authorities’ heightened scrutiny over financial practices that jeopardize domestic investors and the integrity of American financial markets.

A Broader Context of Anti-Corruption Efforts

This high-profile case highlights broader efforts by U.S. law enforcement agencies to mitigate corruption and promote legal compliance within international business dealings. Actions spearheaded by the U.S. Attorney's Office for the Eastern District of New York, alongside the U.S. Department of Justice's Fraud Unit in Washington, underscore a robust intent to address and curb fraudulent practices implicating U.S. entities. This case is emblematic of the increasing dynamism of international regulatory frameworks aiming to uphold fair business practices.

Response from Adani Group

In response to the accusations, the Adani Group, under Gautam Adani's leadership, has promptly issued a statement categorically dismissing the allegations as unfounded. The statement emphasizes the conglomerate’s compliance with legal and ethical standards, underscoring its contention that the charges are baseless. Despite this assertion, the legal landscape now confronting the Adani Group presents formidable challenges that could impact the conglomerate's operations and ethos.

Gautam Adani's prominence as the world’s 19th richest individual, with an approximate net worth of $85.5 billion, is leveraged on the success of his multifaceted conglomerate. The Adani Group's portfolio spans numerous sectors, ranging from coal production and defense equipment to renewable energy sources. The indictment, therefore, not only threatens legal repercussions but also casts a shadow over Adani's business empire and the vast assets associated with it.

As these legal proceedings unfold, the international business community is attentively monitoring developments. The potential outcomes bear significant ramifications, both for the Adani Group's future endeavors and for ongoing global discussions about transparent and lawful business practices. Stakeholders, investors, and regulatory bodies around the world are keenly watching to see whether this significant legal confrontation will redefine approaches to corporate governance and international business integrity.