On , United Forum of Bank Unions (UFBU) called off a two‑day strike that had been slated for March 24‑25. The decision came after a conciliatory meeting with the Chief Labour Commissioner, where the Indian Banks' Association (IBA) and the Finance Ministry offered concrete assurances on recruitment, performance‑linked incentives and a five‑day workweek. Bank unions said the move would spare the public sector banking system from a near‑total shutdown just weeks before the financial year closed.

Background: A Decade‑Long Staffing Crunch

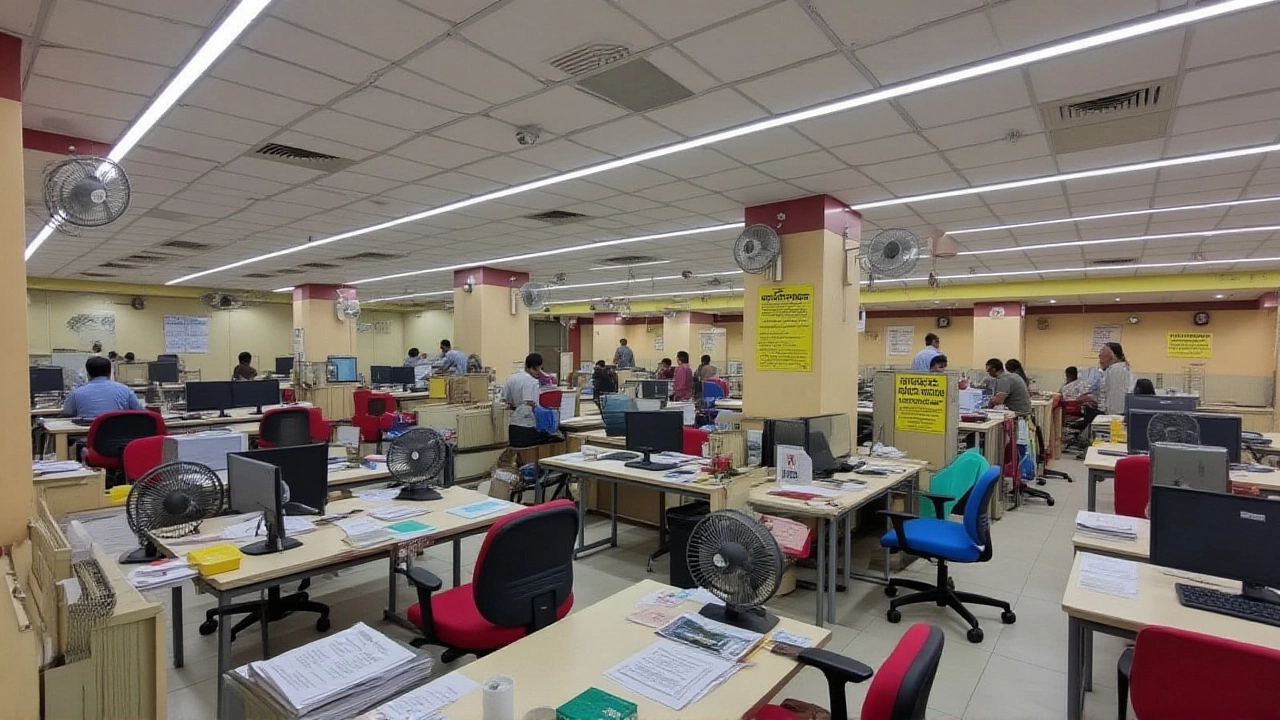

Public sector banks have been feeling the squeeze for ten years. Employee headcount fell from 842,813 in 2015 to 746,679 in 2025, even as the volume of business swelled by a factor of 2.65. The Department of Financial Services (DFS) figures show deposit accounts jumping from 931,315,889 to 1,665,628,000, total deposits climbing from ₹5,885,429 crores to ₹12,088,599 crores, and loan accounts soaring from 7,678,442 to 123,631,582.

- Accounts per employee: now 2,396 (six times higher than private‑bank peers).

- Credit outstanding: up from ₹4,598,075 crores to ₹8,755,324 crores.

- Staff shortage: a deficit of roughly 96,000 officers across all cadres.

The pressure on tellers and officers has turned routine transactions into marathon sessions. Thomas Franco, former General Secretary of the All India Bank Officers' Confederation, warned that the chronic understaffing could erode service quality and heighten systemic risk.

Union Mobilization and the Planned Strike

Representing nine distinct employee bodies—including the All India Bank Employees Association (AIBEA), the All India Bank Officers' Confederation and the National Confederation of Bank Employees—UFBU launched a series of actions starting mid‑February. A massive rally on February 14 illuminated the scale of discontent, followed by a badge‑wearing protest on February 28 where staff across dozens of branches displayed red pins to symbolize rising workloads.

The crescendo was a dharna outside Parliament in New Delhi on March 3. Speakers warned that without swift remedial steps, a strike would cripple not only banking operations but also the broader economy that leans heavily on public‑sector credit channels.

Among the key grievances were the recent DFS directives mandating stricter performance reviews and the rollout of performance‑linked incentives (PLI). Workers feared these moves would further erode job security and morale.

Conciliation Meeting and the Strike Cancellation

At the March 22 meeting, C H Venkatachalam, General Secretary of AIBEA, summed up the unions’ stance: “IBA has proposed further discussions on recruitment, PLI, and other key issues. The Chief Labour Commissioner has assured direct monitoring of the five‑day banking implementation.” The assurance on a five‑day workweek was a turning point; it signaled a willingness to address the root cause of employee overload.

In exchange, UFBU agreed to suspend the strike, with the understanding that IBA would present a progress report by the next hearing on . The report must cover concrete steps on recruitment drives, revision of the Gratuity Act for bank workers, and any tax exemptions the unions have sought.

The cancellation also meant that banks would continue to observe existing public holidays—second and fourth Saturdays and Sundays, plus national holidays like Republic Day, Independence Day and Gandhi Jayanti—as published by the Reserve Bank of India (RBI). Physical branch services will be suspended on those days, but digital channels remain fully operational.

Implications for the Banking Sector

By averting a nationwide shutdown, the government and banking bodies have averted an economic ripple that could have hit small businesses reliant on cash deposits and loan disbursements. Yet the underlying staffing squeeze remains. Analysts note that if recruitment does not accelerate, the same pressure could surface again, perhaps prompting more disruptive actions later in the year.

Banking experts also point out that the PLI scheme, while intended to boost productivity, may backfire if employees feel it punishes them for circumstances beyond their control—namely, the sheer volume of accounts per officer. A balanced approach, they argue, would couple incentive reforms with a genuine increase in headcount.

On the policy front, the Finance Ministry’s promise to revisit the Gratuity Act could align bank employee benefits with those of central government staff, a move that may improve retention in the long run.

Next Steps and Outlook

The April 22 hearing will be a litmus test. Should IBA deliver measurable recruitment numbers—say, hiring an additional 10,000 officers across the country—it could defuse tensions for the foreseeable future. Conversely, a vague report could reignite protest activity, especially as the financial year draws to a close.

Meanwhile, union leaders have hinted at a “phase‑two” dialogue focusing on digital upskilling and workload automation, acknowledging that sheer headcount alone won’t solve the problem if the transaction load keeps climbing.

For customers, the immediate takeaway is continuity: no service interruption is expected, and banks will keep processing online and ATMs transactions as usual. But keep an eye on upcoming announcements from IBA and the Finance Ministry—any shift in staffing policy will eventually filter down to branch wait times and service quality.

Frequently Asked Questions

Why did the bank unions decide to cancel the strike?

The unions received written assurances from the Indian Banks' Association and the Finance Ministry on recruitment, a five‑day workweek and a review of performance‑linked incentives. Those guarantees convinced them that a strike was no longer necessary at that moment.

What are the main demands of the UFBU?

Key demands include hiring additional staff to reverse a ten‑year decline in employee numbers, implementing a five‑day workweek, withdrawing the recent DFS directives on performance reviews, amending the Gratuity Act for bank workers and securing tax exemptions for certain allowances.

How will the cancellation affect customers?

Customers will see no disruption to banking services; branches will remain open on regular days, and digital channels will continue operating normally. The only change is that the planned strike‑induced shutdown will not occur.

When is the next official review of the unions' demands?

The Indian Banks' Association must submit a progress report at a hearing scheduled for , detailing recruitment numbers, PLI revisions and any changes to the Gratuity Act.

What could happen if the staffing issues are not resolved?

Continued understaffing could lead to longer wait times at branches, increased stress on existing employees, and possibly renewed industrial action later in the year, especially as the volume of accounts per officer remains six times higher than in the private sector.